Vector Autoregression#

In this notebook we will run Vector Autoregression (VAR) using python packages. We will revisit the exercise from Vector Autoregression by Stock and Watson (2001).

VAR(p) Process###

We are interested in modeling a \(T\times K\) multivariate time series \(Y\), where \(T\) denotes the number of observations and \(K\) the number of variables. One way of estimating relationships between the time series and their lagged values is the vector autoregression process:

\[

Y_t = A + B_1 Y_{t-1} + B_2 Y_{t-2} + \cdots + A_p Y_{t-p} + u_t

\]

where \(u_t \sim N(0,\sigma_u)\) and \(A_i\) is a \(K\times K\) coefficient matrix.

import pandas as pd

import numpy as np

import statsmodels.api as sm

from statsmodels.tsa.api import VAR

Prepare data#

data = pd.read_excel('SW2001_data.xlsx')

data.index = pd.DatetimeIndex(data['obs'])

data_use = data[['Inflation','Unemployment','Fed Funds']]

---------------------------------------------------------------------------

FileNotFoundError Traceback (most recent call last)

Cell In[2], line 1

----> 1 data = pd.read_excel('SW2001_data.xlsx')

2 data.index = pd.DatetimeIndex(data['obs'])

3 data_use = data[['Inflation','Unemployment','Fed Funds']]

File ~/python313/lib/python3.13/site-packages/pandas/io/excel/_base.py:495, in read_excel(io, sheet_name, header, names, index_col, usecols, dtype, engine, converters, true_values, false_values, skiprows, nrows, na_values, keep_default_na, na_filter, verbose, parse_dates, date_parser, date_format, thousands, decimal, comment, skipfooter, storage_options, dtype_backend, engine_kwargs)

493 if not isinstance(io, ExcelFile):

494 should_close = True

--> 495 io = ExcelFile(

496 io,

497 storage_options=storage_options,

498 engine=engine,

499 engine_kwargs=engine_kwargs,

500 )

501 elif engine and engine != io.engine:

502 raise ValueError(

503 "Engine should not be specified when passing "

504 "an ExcelFile - ExcelFile already has the engine set"

505 )

File ~/python313/lib/python3.13/site-packages/pandas/io/excel/_base.py:1550, in ExcelFile.__init__(self, path_or_buffer, engine, storage_options, engine_kwargs)

1548 ext = "xls"

1549 else:

-> 1550 ext = inspect_excel_format(

1551 content_or_path=path_or_buffer, storage_options=storage_options

1552 )

1553 if ext is None:

1554 raise ValueError(

1555 "Excel file format cannot be determined, you must specify "

1556 "an engine manually."

1557 )

File ~/python313/lib/python3.13/site-packages/pandas/io/excel/_base.py:1402, in inspect_excel_format(content_or_path, storage_options)

1399 if isinstance(content_or_path, bytes):

1400 content_or_path = BytesIO(content_or_path)

-> 1402 with get_handle(

1403 content_or_path, "rb", storage_options=storage_options, is_text=False

1404 ) as handle:

1405 stream = handle.handle

1406 stream.seek(0)

File ~/python313/lib/python3.13/site-packages/pandas/io/common.py:882, in get_handle(path_or_buf, mode, encoding, compression, memory_map, is_text, errors, storage_options)

873 handle = open(

874 handle,

875 ioargs.mode,

(...)

878 newline="",

879 )

880 else:

881 # Binary mode

--> 882 handle = open(handle, ioargs.mode)

883 handles.append(handle)

885 # Convert BytesIO or file objects passed with an encoding

FileNotFoundError: [Errno 2] No such file or directory: 'SW2001_data.xlsx'

data_use.head(10)

| Inflation | Unemployment | Fed Funds | |

|---|---|---|---|

| obs | |||

| 1960-01-01 | 0.908472 | 5.133333 | 3.933333 |

| 1960-04-01 | 1.810777 | 5.233333 | 3.696667 |

| 1960-07-01 | 1.622720 | 5.533333 | 2.936667 |

| 1960-10-01 | 1.795335 | 6.266667 | 2.296667 |

| 1961-01-01 | 0.537033 | 6.800000 | 2.003333 |

| 1961-04-01 | 0.714924 | 7.000000 | 1.733333 |

| 1961-07-01 | 0.891862 | 6.766667 | 1.683333 |

| 1961-10-01 | 1.067616 | 6.200000 | 2.400000 |

| 1962-01-01 | 2.303439 | 5.633333 | 2.456667 |

| 1962-04-01 | 1.234841 | 5.533333 | 2.606667 |

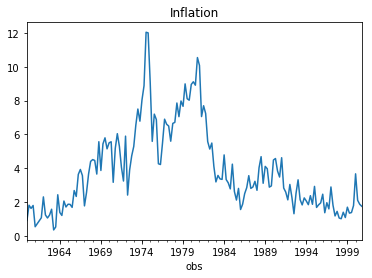

data['Inflation'].plot(title = 'Inflation')

<matplotlib.axes._subplots.AxesSubplot at 0x2341fa7d7b8>

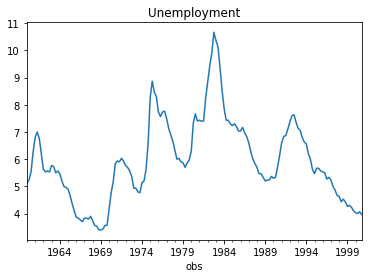

data['Unemployment'].plot(title = 'Unemployment')

<matplotlib.axes._subplots.AxesSubplot at 0x2341fae3978>

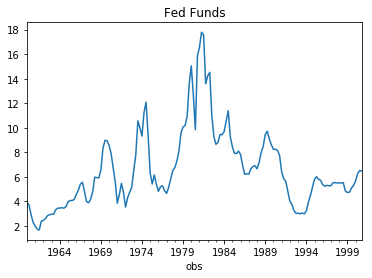

data['Fed Funds'].plot(title = 'Fed Funds')

<matplotlib.axes._subplots.AxesSubplot at 0x2341fabf2e8>

# compute changes

data_ret = np.log(data_use).diff().dropna()

# construct model

model = VAR(data_ret)

Fitting#

# Fit model using 8 lags

results = model.fit(8)

results.summary()

Summary of Regression Results

==================================

Model: VAR

Method: OLS

Date: Thu, 24, Oct, 2019

Time: 22:10:24

--------------------------------------------------------------------

No. of Equations: 3.00000 BIC: -11.9402

Nobs: 155.000 HQIC: -12.8147

Log likelihood: 454.689 FPE: 1.50862e-06

AIC: -13.4128 Det(Omega_mle): 9.63293e-07

--------------------------------------------------------------------

Results for equation Inflation

==================================================================================

coefficient std. error t-stat prob

----------------------------------------------------------------------------------

const -0.006230 0.024131 -0.258 0.796

L1.Inflation -0.514844 0.084061 -6.125 0.000

L1.Unemployment -1.748654 0.754045 -2.319 0.020

L1.Fed Funds 0.243865 0.280358 0.870 0.384

L2.Inflation -0.475297 0.094742 -5.017 0.000

L2.Unemployment 1.013126 0.865082 1.171 0.242

L2.Fed Funds -0.038629 0.273746 -0.141 0.888

L3.Inflation -0.232324 0.107010 -2.171 0.030

L3.Unemployment -0.456089 0.870524 -0.524 0.600

L3.Fed Funds 0.162914 0.277477 0.587 0.557

L4.Inflation -0.084555 0.108784 -0.777 0.437

L4.Unemployment -1.379885 0.872522 -1.581 0.114

L4.Fed Funds -0.334072 0.276643 -1.208 0.227

L5.Inflation -0.182486 0.106265 -1.717 0.086

L5.Unemployment -0.029769 0.850554 -0.035 0.972

L5.Fed Funds 0.680054 0.281418 2.417 0.016

L6.Inflation -0.101231 0.105147 -0.963 0.336

L6.Unemployment 0.136967 0.844978 0.162 0.871

L6.Fed Funds -0.063789 0.293058 -0.218 0.828

L7.Inflation -0.139909 0.095271 -1.469 0.142

L7.Unemployment 0.580131 0.842873 0.688 0.491

L7.Fed Funds 0.375119 0.271349 1.382 0.167

L8.Inflation 0.036261 0.084094 0.431 0.666

L8.Unemployment -0.343938 0.751441 -0.458 0.647

L8.Fed Funds 0.263864 0.267509 0.986 0.324

==================================================================================

Results for equation Unemployment

==================================================================================

coefficient std. error t-stat prob

----------------------------------------------------------------------------------

const -0.001997 0.002961 -0.674 0.500

L1.Inflation 0.008867 0.010314 0.860 0.390

L1.Unemployment 0.527872 0.092521 5.705 0.000

L1.Fed Funds 0.025336 0.034400 0.737 0.461

L2.Inflation -0.000303 0.011625 -0.026 0.979

L2.Unemployment 0.011744 0.106146 0.111 0.912

L2.Fed Funds 0.054435 0.033589 1.621 0.105

L3.Inflation 0.003959 0.013130 0.301 0.763

L3.Unemployment 0.205597 0.106813 1.925 0.054

L3.Fed Funds 0.029335 0.034046 0.862 0.389

L4.Inflation -0.005784 0.013348 -0.433 0.665

L4.Unemployment -0.241164 0.107058 -2.253 0.024

L4.Fed Funds 0.067844 0.033944 1.999 0.046

L5.Inflation 0.004443 0.013039 0.341 0.733

L5.Unemployment 0.105290 0.104363 1.009 0.313

L5.Fed Funds 0.028239 0.034530 0.818 0.413

L6.Inflation -0.006386 0.012902 -0.495 0.621

L6.Unemployment 0.115584 0.103679 1.115 0.265

L6.Fed Funds 0.051140 0.035958 1.422 0.155

L7.Inflation -0.006154 0.011690 -0.526 0.599

L7.Unemployment 0.171264 0.103421 1.656 0.098

L7.Fed Funds 0.023369 0.033295 0.702 0.483

L8.Inflation 0.002696 0.010318 0.261 0.794

L8.Unemployment -0.135425 0.092202 -1.469 0.142

L8.Fed Funds 0.041069 0.032823 1.251 0.211

==================================================================================

Results for equation Fed Funds

==================================================================================

coefficient std. error t-stat prob

----------------------------------------------------------------------------------

const 0.001046 0.008043 0.130 0.897

L1.Inflation 0.064263 0.028017 2.294 0.022

L1.Unemployment -1.224222 0.251322 -4.871 0.000

L1.Fed Funds 0.164840 0.093443 1.764 0.078

L2.Inflation 0.102123 0.031577 3.234 0.001

L2.Unemployment 0.325859 0.288331 1.130 0.258

L2.Fed Funds -0.283395 0.091239 -3.106 0.002

L3.Inflation 0.044423 0.035666 1.246 0.213

L3.Unemployment -0.547087 0.290144 -1.886 0.059

L3.Fed Funds 0.141328 0.092483 1.528 0.126

L4.Inflation 0.036794 0.036258 1.015 0.310

L4.Unemployment 0.428170 0.290810 1.472 0.141

L4.Fed Funds 0.097451 0.092205 1.057 0.291

L5.Inflation -0.007478 0.035418 -0.211 0.833

L5.Unemployment 0.228524 0.283488 0.806 0.420

L5.Fed Funds 0.223071 0.093796 2.378 0.017

L6.Inflation 0.048230 0.035045 1.376 0.169

L6.Unemployment -0.114713 0.281630 -0.407 0.684

L6.Fed Funds -0.091599 0.097676 -0.938 0.348

L7.Inflation 0.001792 0.031754 0.056 0.955

L7.Unemployment -0.217228 0.280928 -0.773 0.439

L7.Fed Funds -0.108129 0.090440 -1.196 0.232

L8.Inflation 0.048463 0.028028 1.729 0.084

L8.Unemployment 0.087416 0.250454 0.349 0.727

L8.Fed Funds 0.013047 0.089161 0.146 0.884

==================================================================================

Correlation matrix of residuals

Inflation Unemployment Fed Funds

Inflation 1.000000 -0.069101 0.071163

Unemployment -0.069101 1.000000 -0.406512

Fed Funds 0.071163 -0.406512 1.000000

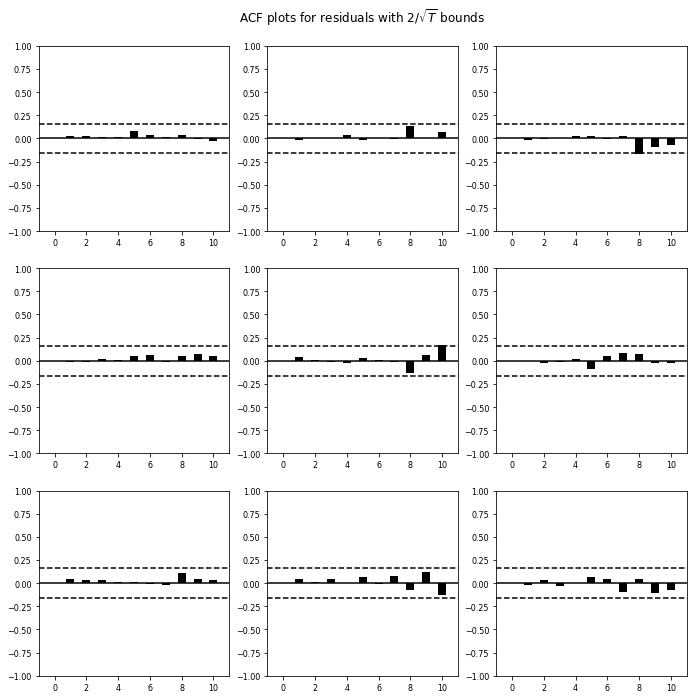

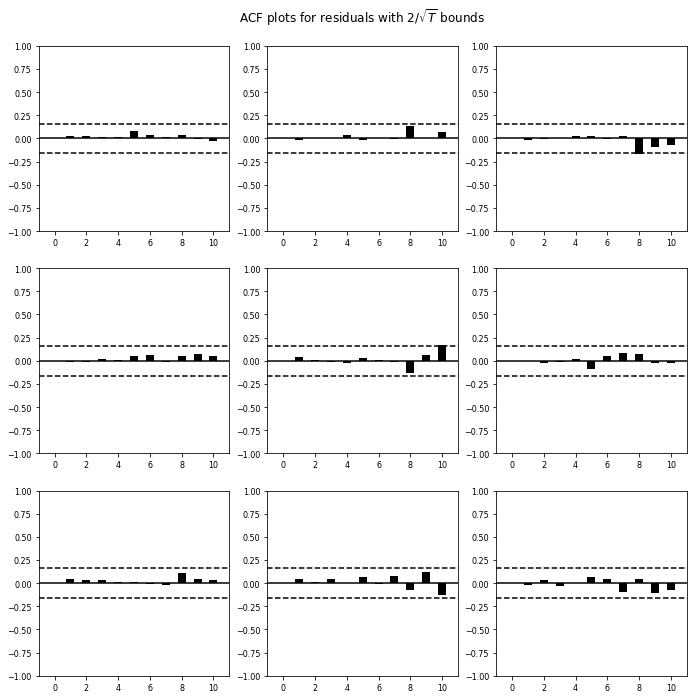

Plot autocurrelation function#

results.plot_acorr()

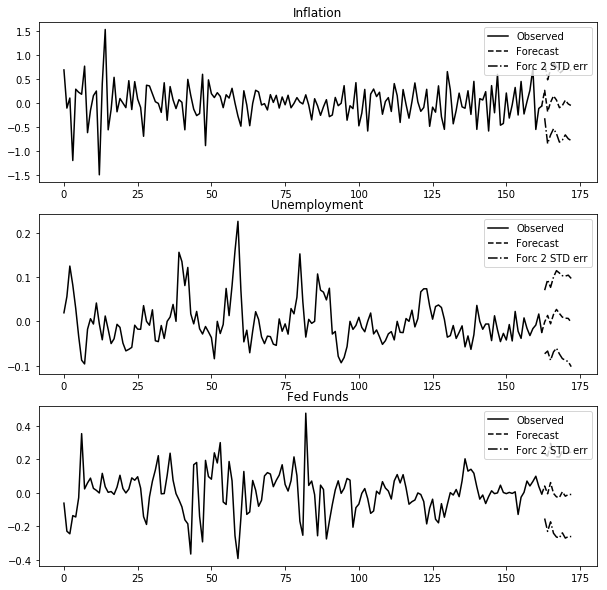

Forecasting#

lag_order = results.k_ar

# forecast 8 periods foreward

results.forecast(data_ret.values[-lag_order:],8)

array([[ 0.26208636, -0.00142003, 0.04035941],

[-0.18498492, 0.01331739, -0.0058817 ],

[ 0.01173027, -0.00553678, 0.06132789],

[ 0.1458359 , 0.01553199, -0.00364107],

[ 0.05902579, 0.02686258, -0.02417997],

[-0.10098058, 0.01769744, -0.02785083],

[-0.05486938, 0.00946074, 0.00594001],

[ 0.05403755, 0.00719963, -0.02022299]])

results.plot_forecast(10)

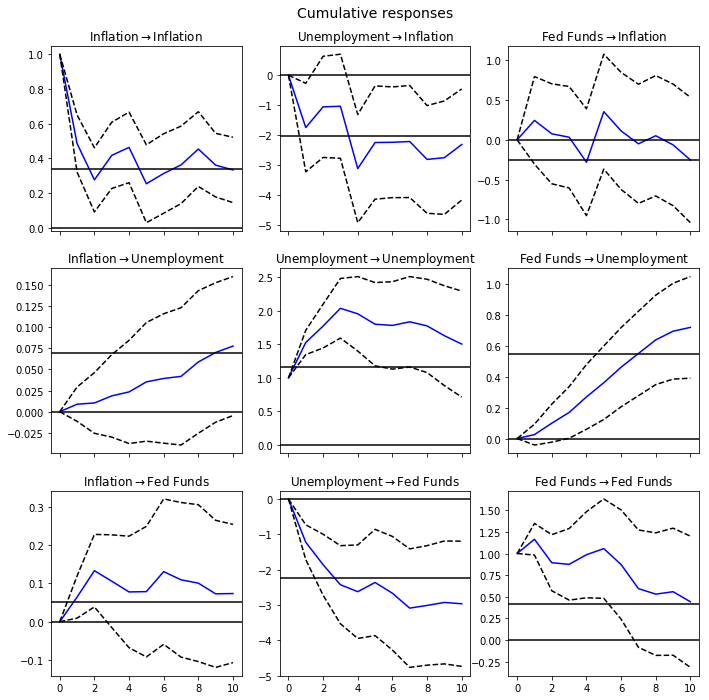

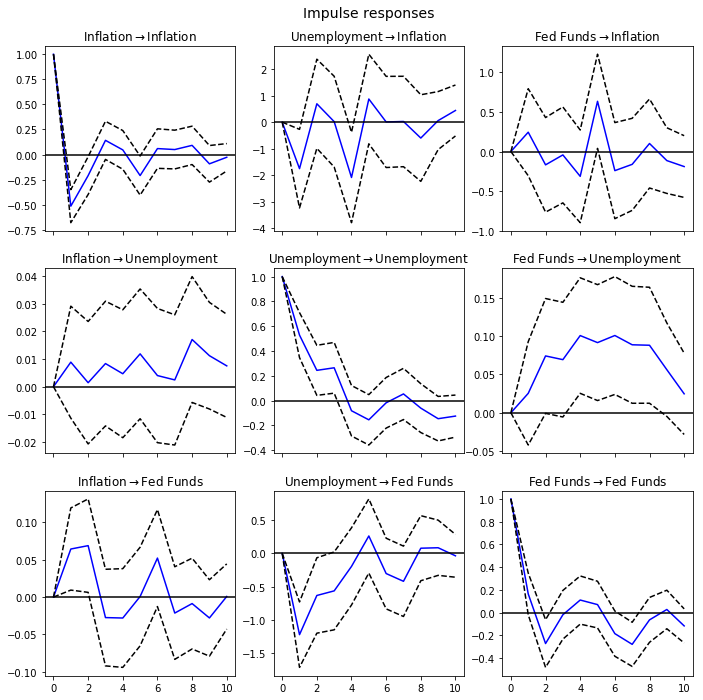

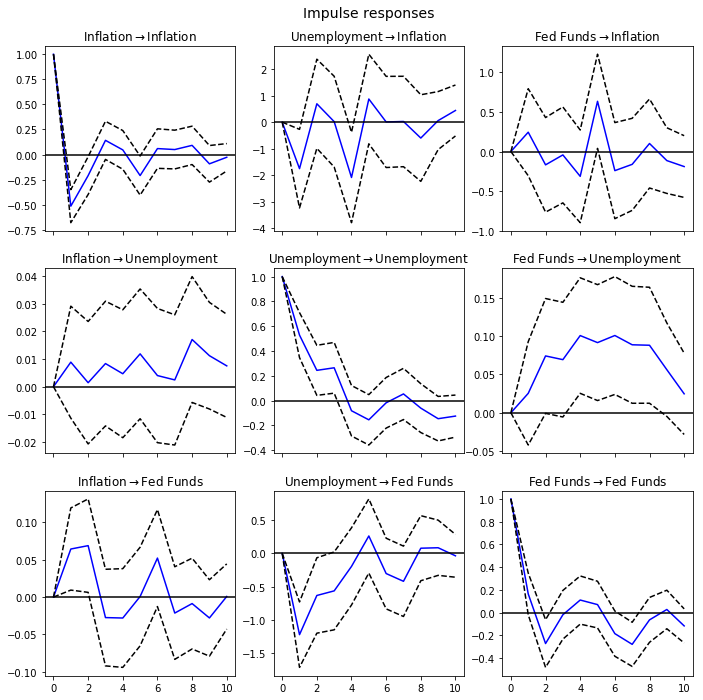

Impulse Response Function (IRF)#

irf = results.irf(10)

irf.plot(orth=False)

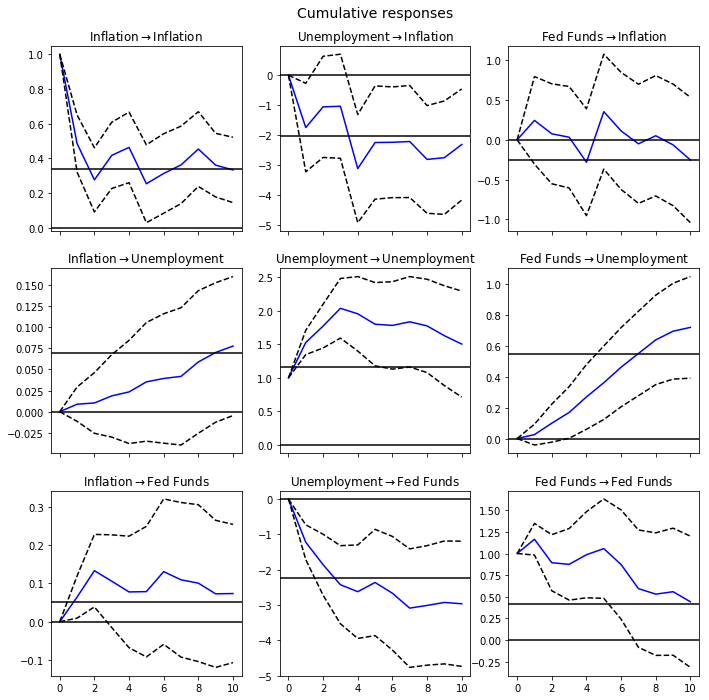

Cumulative Effect#

irf.plot_cum_effects(orth=False)